A New GST Era: What’s Changing in 2025?

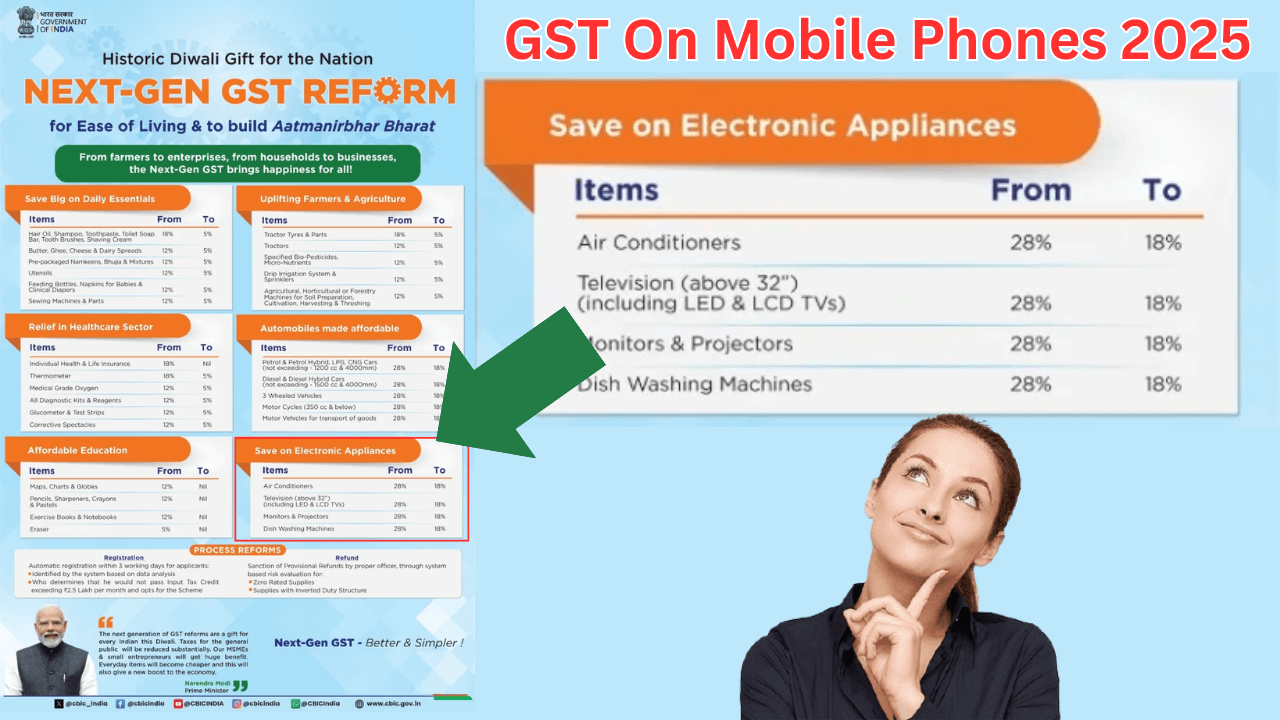

The GST Council has rolled out a big change for 2025. Starting September 22, India is moving from a complicated four-tier system to a cleaner, two-tier tax structure. Instead of the old 12% and 28% slabs, we’ll now see just 5% and 18% as the main brackets.

And here’s the kicker—there’s also a brand-new 40% “sin/luxury” slab. This one’s reserved for premium items like luxury cars, large SUVs, and of course, tobacco products. Basically, the stuff the government wants to tax heavily.

Finance Minister Nirmala Sitharaman made it clear that this overhaul is designed with everyday consumers in mind. The goal? Make essentials more affordable, give people breathing room in their budgets, and spark more spending—especially as India gears up for the big festive season rush.

Why Festive Shoppers Are Watching Closely

Whenever Diwali and Navaratri roll around, wallets open wide. Families plan big-ticket buys—home appliances, two-wheelers, even new phones. That’s why this GST revamp has sparked so much buzz.

The chatter on the ground is simple: will this tax reshuffle make things cheaper? Will prices dip for everyday goods, or will only certain categories feel the difference?

Naturally, one product has everyone’s attention—mobile phones. They’re not just gadgets anymore; they’re lifelines. And let’s be honest, who doesn’t think about upgrading their phone when festival deals start popping up?

The Burning Question: Will Phones Get Cheaper?

Here’s the straightforward answer—no, mobile phones are not getting cheaper.

Despite all the noise about GST simplification, the rate for mobile phones remains fixed at 18%. The Council has scrapped the 12% and 28% slabs, but the 18% bracket stays firmly in place for smartphones.

This means whether you’re eyeing that budget-friendly device or the latest premium flagship, don’t expect a tax cut to bring the price down.

What the Industry Has Been Saying

Even before the official announcement, phone manufacturers weren’t holding their breath. Industry insiders had already hinted that rates wouldn’t fall to 5%—the only number that could have made smartphones significantly cheaper.

Unless that miracle happened, the expectation was clear: smartphone prices will hold steady. And now, with the confirmation that 18% remains unchanged, those predictions were spot-on.

So, What Does This Really Mean for You?

If you’re waiting for the GST revamp to slash phone prices, you’ll be disappointed. The government may be easing the burden on several essential goods, but smartphones don’t make the cut.

Instead, what shoppers can expect this festive season is more of the same—competitive discounts from retailers, exchange offers, and festival deals from e-commerce giants. But the tax angle? That won’t be bringing any relief.

Looking Beyond Phones

Now, here’s where things do get interesting. While mobile phones remain stuck at 18%, the rationalization of tax slabs could impact a wide range of other products. Everyday items might get cheaper, while luxury and sin goods—like that fancy SUV or a pack of cigarettes—will now face the new 40% slab.

So yes, consumers will likely see changes elsewhere. Just not in their smartphone shopping carts.

The Bottom Line

The GST overhaul is a big deal—it simplifies a messy system, aims to ease the cost of living, and sets the stage for more transparent taxation. But if you’re a smartphone shopper hoping for relief, the reality is blunt: mobile phones are not part of the discount story.

They remain firmly under the 18% GST bracket. Which means your best bet for a cheaper phone this festive season? Keep an eye out for sales, not tax reforms.